What is Local Law 87?

Local Law 87 of 2009 requires owners of applicable, mixed-use, and residential buildings to submit an Energy Efficiency Report (EER) every ten years.

When do I need to file an EER for my building?

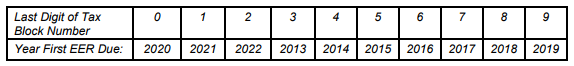

The deadline for filing for an EER for your building is directly related to the last digit of your property’s tax block number.

The last digit of the property tax block number (0 – 9) corresponds with the last digit in the calendar year (0 – 9). For example, if the last digit of your property tax block number is 8, then 2018 is the deadline for you to file. If your tax block number is 9, then 2019 is your deadline, and so on. The figure below shows the potential numbers and their corresponding year starting with 2013.

If the last digit of your property tax block number is 7, then December 31, 2017 is the deadline for you to file for an EER. Refer to the DOB’s August 2014 Service Update for more information.

What are the exceptions?

- New buildings (NBs) with a First Temporary Certificate of Occupancy that is less than ten years old at the time the building is due to comply with LL87.

- For existing buildings that are undergoing Alt-1 alterations, owners must submit a Request for Deferral and proof of compliance with the NYC Energy Code that was in effect at the time of application approval of the alteration. Proof of compliance must include all lesser and included permits affecting base building systems.

- For buildings that are undergoing Alt-2 and Alt-3 alterations, which are causing difficulty with compliance during the year in which they are due, owners should submit an extension request. Extension requests are due by October 1st.

*The due date for the property would then be extended by one year. Up to two extensions may be granted.

If you would like assistance with filing an EER or requesting an extension for your building, please contact Milrose Consultants and we will be happy to assist you.